金本位历史

前言:公元前三千年以前,黄金在古国埃及第一次被人类所认知。凭借徇烂的外表,逐渐被被人类所使用,由于黄金少、易储存、延展性强、耐腐蚀等自然属性,广为世人所认可,逐渐成为世人所交易的对象。

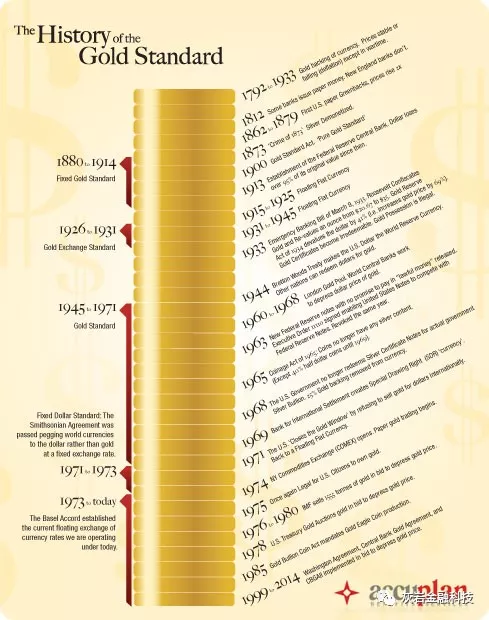

经过漫长时期,金本位制始于1816年的英国,到19世纪末,世界上主要的国家基本上都实行了金本位,随着金本位制的形成,黄金承担了商品交换的一般等价物,成为商品交换过程中的媒介,黄金的社会流动性增加。黄金市场的发展有了客观的社会条件和经济需求。

第一次世界大战以后,许多欧美资本主义国家的经济受到通货膨胀、物价飞速上涨的影响,加之黄金分配极不均衡,已经难以恢复金币本位制。1922年在意大利热那亚城召开的世界货币会议上决定采用“节约黄金”的原则,实行金砖本位制和金汇兑本位制。

在金砖本位制度下,各国央行发行的纸币货币单位仍然规定含金量,但黄金只作为货币发行的准备金集中于中央银行,而不再铸造金币和实行金币流通,流通中的货币完全由银行发行的纸币货币单位所代替,由各国的中央银行掌管和控制黄金的输出和输入,禁止私人买卖黄金。保持一定数量的黄金储备,以维持黄金与货币之间的联系。

第一次世界大战爆发后,英国正式在1919年停止实行金本位制度,于1926年恢复使用金砖本位制度。但只允许中央银行及各国政府之间进行黄金交易活动。1944年7月1日,44个国家或政府的经济特使在美国新罕布什尔州的布雷顿森林召开了联合国货币金融会议,确立美元与黄金挂钩。

60年代,美国由于陷入越战泥潭,政府财政赤字不断增加,国际收入情况恶化,美元出现不可抑制的通货膨胀,美元的信誉受到极大的冲击。同期战后的欧洲国家经济开始复苏,为了资产保值黄金就成了最好选择,于是各国为了避险美元危机和财富保值需求而纷纷抛出美元向美国兑换黄金,使美国政府承诺的美元同黄金的固定兑换率日益难以维持。到1971年,美国的黄金储备减少了60%以上。美国政府被迫放弃按固定官价美元兑换黄金的政策,各西方国家货币也纷纷与美元脱钩,金价进入由市场自由浮动定价的时期,布雷顿森林国际货币体系彻底崩溃。

1976年,IMF(国际货币基金组织)通过《牙买加协议》,废除黄金货币化,设立特别提款权代替黄金。虽然废除了黄金作为货币使用,不过由于黄金的金属属性并没有被世人抛弃,依然受到国家和个人投资的青睐

The Historical Price of Gold

Price of Gold

Since time immemorial the price of gold has continued to be stable because man has always recognized its worth.

自远古以来,黄金的价格一直保持稳定,因为人们一直认识到它的价值。

Thousands of years ago gold was a rare commodity and it still is today. The people of ancient times, having realized the worth and rarity of gold, used it as a mode of currency as well as for ornamentation purposes.

数千年前,黄金是一种罕见的商品,现在仍然如此。古代人民意识到黄金的价值和稀有性,将其用作货币模式以及装饰用途。

For centuries gold has been an integral part of economics and money systems. In fact the economies of many nations were historically determined on the basis of their gold stock. The result has been that gold prices have always trended upwards.

几个世纪以来,黄金一直是经济和货币体系中不可或缺的一部分。 实际上,许多国家的经济历史上是根据其黄金储备来确定的。 结果是黄金价格总是趋于上涨。

In today’s turbulent global economy investing in this precious metal is becoming an increasingly important and popular component in maintaining a healthy and profitable investment portfolio.

在当今动荡的全球经济中,投资这种贵金属正成为维持健康和有利可图的投资组合中越来越重要和受欢迎的组成部分。

Going Back In History

回到历史

Let’s find out how gold was used by man as a form of currency. For this, we have to go back to the times of the ancient Egyptians and Sumerians. It was they who first understood the value of gold along with other precious metals.

让我们来看看人类如何使用黄金作为一种货币形式。为此,我们必须回到古埃及人和苏美尔人的时代。他们首先了解黄金与其他贵金属的价值。

They began to use gold for ornamentation. Later they started to make gold coins. Before the advent of gold coins, the exchange of goods and services were based on the barter system. The introduction of gold coins brought about a new scenario. People began to use it as a form of currency to buy goods and services. As a result, the price of gold began its ascendancy.

他们开始用黄金装饰。 后来他们开始制作金币。 在金币出现之前,货物和服务的交换是基于易货系统。金币的推出带来了新的情景。 人们开始将其用作购买商品和服务的一种货币形式。 结果,黄金价格开始上涨。

As time passed, in addition to gold coins world economies introduced a new form of currency – paper money. This development did not undermine the value of gold however and the price for gold remained unaffected.

随着时间的推移,除了金币外,世界经济还推出了一种新形式的货币 - 纸币。然而,这一发展并没有削弱黄金的价值,黄金的价格也没有受到影响。

Until the 20th century, there existed a ‘gold standard’ which is defined as ‘a monetary system in which the standard economic unit of account is a fixed mass of gold’. During those times the price of gold was more or less fixed and as such was conducive for fair trade.

直到20世纪,存在一个“黄金标准”,它被定义为“货币体系,其中标准经济单位是固定的黄金质量”。 在那段时间里,黄金的价格或多或少是固定的,因此有利于公平贸易。

It didn’t fluctuate much because paper money could be easily converted into gold or other precious metals. Even if it did fluctuate it was only marginal (just a few cents) with the purpose being to meet expenses like shipping and insurance.

由于纸币很容易转化为黄金或其他贵金属,因此波动幅度不大。即使它确实波动,它只是边际(只有几美分),目的是为了满足航运和保险等费用。

The First World War had a deep impact on money convertibility. Since many leading countries of the world were involved, it became increasingly difficult to transfer wealth.

第一次世界大战对货币兑换产生了深远的影响。由于世界上许多主要国家都参与其中,因此转移财富变得越来越困难。

It also affected the exchange rate that was previously fixed worldwide. Political alliances and varying foreign exchange rates affected the stability of gold bullion and as a result the price of gold began to fluctuate.

它还影响了以前在全球范围内修正的汇率。政治联盟和不同的外汇汇率影响了金条的稳定性,因此黄金价格开始波动。

The beginning of the 20th century brought with it many changes. It left behind the old standard of backing paper money with gold or other precious metals. Countries like the U.S. and UK abandoned gold and instead pursued a policy of increasing the production of paper currency.

20世纪初带来了许多变化。它遗留了用黄金或其他贵金属支持纸币的旧标准。像美国和英国这样的国家放弃了黄金,而是采取了增加纸币生产的政策。

This ushered in a new era of gold investing and the market was opened up to accommodate it.

这开启了投资黄金的新时代,市场开放以适应它。

The 1940s witnessed a surge in the mining industry and during that time production almost doubled. At that time the gold price was $35 an ounce. Thereafter the price began to climb steadily. People realized the advantages of investing in gold. Moreover, since in terms of worth gold had an inherent stability more and more investors began to invest in this precious metal.

20世纪40年代见证了采矿业的激增,在此期间,产量几乎翻了一番。当时黄金价格为每盎司35美元。此后价格开始稳步攀升。人们意识到投资黄金的优势。而且,由于在价值方面黄金具有固有的稳定性,越来越多的投资者开始投资这种贵金属。

1971 – A Major Turning Point For The Price of Gold

1971年 - 黄金价格的一个重要转折点

Since the 20th century there has been a surge in gold investing and as a result the price of gold has maintained an upward trend. Gold as a strong investment vehicle increased dramatically post 1971 when the global economy completely discarded gold as an anchor for paper money. This was due to President Nixon ending the Bretton Woods exchange and removing the gold standard from the US dollar.

自20世纪以来,黄金投资一直在激增,因此黄金价格一直保持上涨趋势。1971年全球经济完全抛弃黄金作为纸币的锚点,黄金作为强大的投资工具大幅增加。这是因为尼克松总统结束了布雷顿森林交易所并取消了美元的黄金标准。

This resulted in gold prices hitting a then record high of $850 an ounce in 1980. Of course certain world events like the Soviet invasion of Afghanistan and the Islamic Revolution in Iran which created global tensions were to some extent responsible for this as well.

这导致金价在1980年触及每盎司850美元的历史新高。当然,某些世界事件,如苏联入侵阿富汗和伊朗伊斯兰革命造成全球紧张局势,在某种程度上也是造成这种情况的原因。

Investors scurrying to lower their holdings risk and also to ensure safe investments began to invest in gold because they recognized its inherent stability and underlying worth. The returns they got belied their expectations.

投资者急于降低持股风险,并确保安全投资开始投资黄金,因为他们认识到其固有的稳定性和潜在价值。他们得到的回报超出了他们的预期。

Although the gold price witnessed a meteoric rise to $850 an ounce it did gradually fall back but still remained high in comparison to the level before its rise. Over time investors began to see gold as a form of safe and profitable investment and not just a safe haven in times of crisis. Gold became an attractive and effective investment option to build and maintain wealth and continues to be so today.

尽管黄金价格迅速上涨至每盎司850美元,但它确实逐渐回落,但与其上涨前的水平相比仍然保持高位。随着时间的推移,投资者开始将黄金视为一种安全和有利可图的投资形式,而不仅仅是危机时期的避风港。黄金成为建立和维持财富的有吸引力和有效的投资选择,并且今天仍然如此。

During the economic crisis of the 80’s investors who had put their faith in gold were well rewarded and were able to ride out the storm.

在经济危机期间,80年代投资者对黄金的信心得到了很好的回报,并且能够渡过难关。

Towards the later part of the 20th century, the overall value of gold did hover a bit. When equities skyrocketed in the 90’s they did overshadow the steady values of gold for a while.

接近20世纪后期,黄金的整体价值确实徘徊了一点。当股票在90年代飙升时,他们确实在一段时间内打破了黄金的稳定价值。

But then investors who had invested in gold came out as winners during 2001 and 2007 when many investment portfolios were destroyed by tough markets, recessions and bubbles.

但随后在2001年和2007年投资黄金的投资者成为赢家,当时许多投资组合被严峻的市场,经济衰退和泡沫破坏。

Coming right up to the present day, gold continues to shine. It has roughly doubled in value since the economic crisis of 2008 when it started the year at around $700/oz. This is mainly due to the negative correlation that gold has with stocks, Treasury bills, bonds and the value of the US dollar. What this means is that over time gold has always moved in the opposite direction to these other forms of investment.

直到今天,黄金继续闪耀。自2008年经济危机开始以来,它的价值大致翻了一番,当年开始时的价格约为700美元/盎司。这主要是由于黄金与股票,国债,债券和美元价值的负相关。这意味着随着时间的推移,黄金总是朝着这些其他形式的投资方向发展。

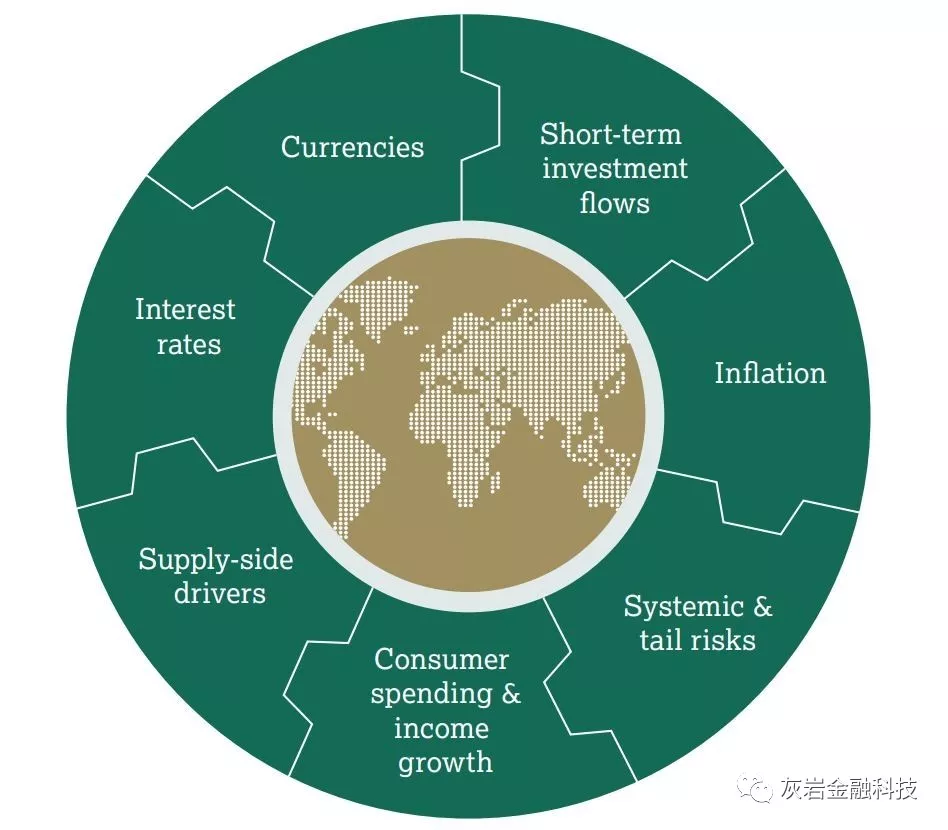

影响黄金的因素

1. 货币因素

2. 利率因素

3. 供应端驱动因素

4. 消费因素和收入增长

5. 系统风险&长尾风险

6. 通胀风险

7. 短期投资流

2019年可能影响黄金价格的十大最重要因素,分为两大类,即经济发展和影响黄金本身的因素。经济基本面变化因素:

1、目前处在信贷周期的后期,而且经济扩张周期似乎即将结束。在这种情况下可以看到,政府赤字将会上升,因经济活动萎缩导致税收减少和福利承诺增加。已然出现的货币通胀率上升将掩盖这一点。

2、国际贸易流量急剧放缓,从中国需求下滑便可看出这点。毫无疑问,美国关税政策正在对国际贸易造成灾难性的影响。

3、除了全球贸易下滑是世界经济陷入困境的清晰信号之外,美国的预算赤字将会上升,因此贸易赤字也将趋于上升。国际贸易萎缩可能会推动美国和其他家庭经济陷入低迷。这势必会促使美联储通过更多量化宽松为美国政府赤字融资。

4、亚洲主要经济体(中国、俄罗斯、印度和伊朗)都在贸易结算上背弃美元。这将对央行储备产生深远的影响,不仅在亚洲,其他地方也是如此,美元正在被抛售。一些国家,尤其是俄罗斯,正在购买黄金。

5、外资拥有的美元资产和现金超过美国GDP:达到22.6万亿美元。这是有史以来相对于GDP的最高比率。当美元和美国证券市场在美元贬值的情况下开始大幅下跌时,外资必然会大量抛售美元和美元资产。

直接影响黄金的因素

6、地缘政治:亚洲和俄罗斯将美元储备换成黄金。鉴于俄罗斯是世界上最大的能源出口国,该国将继续出售美元购买黄金。此外,中欧国家,特别是匈牙利和波兰,正在积累黄金储备。亚洲的风向显而易见,亚洲人知道黄金是美国的弱点。

7、CPI数据严重歪曲了价格通胀,从2011年9月金价见顶以来,通胀平均每年接近8%左右。自那以来,美元的购买力下降了约43%,因此2011年以美元计算的黄金价格应该是740美元。似乎没有人注意到,这使得黄金变得非常便宜。

8、雷曼危机后的货币通胀尚未完全被消化。法定货币量仍比雷曼破产前的长期扩张趋势高出5万亿美元,而且美联储无法将其降低。相反,他们可能会增加法定货币量,以免政府在经济衰退时以市场利率借款。

9、这些正是德国政府在1918年至1923年间所面临的情况,美联储可能也会做出如此反应。印钞以为政府赤字融资。其结果是,从生产经济转化的财富被政府支出所摧毁。唯一的区别是美国和其他福利国家有着比战后德国更强大的税收基础,因此货币扩张速度相对于经济规模会更小。尽管如此,货币仍在走向毁灭,解决通胀问题需要更大的政治勇气。

10、西方的黄金持有量严重偏低。

未经允许不得转载:美股开户者 » 深度理解黄金的价格——历史以及核心因素

美股开户者

美股开户者