由于国内衍生品合约以及交易工具的缺乏(股指期货,上证50ETF期权等),因此许多的系统性风险(systemic risks)使得部位中(Positions)出现的风险敞口(Risks Exposures) 无法得到对冲.

本系列上文可参阅:

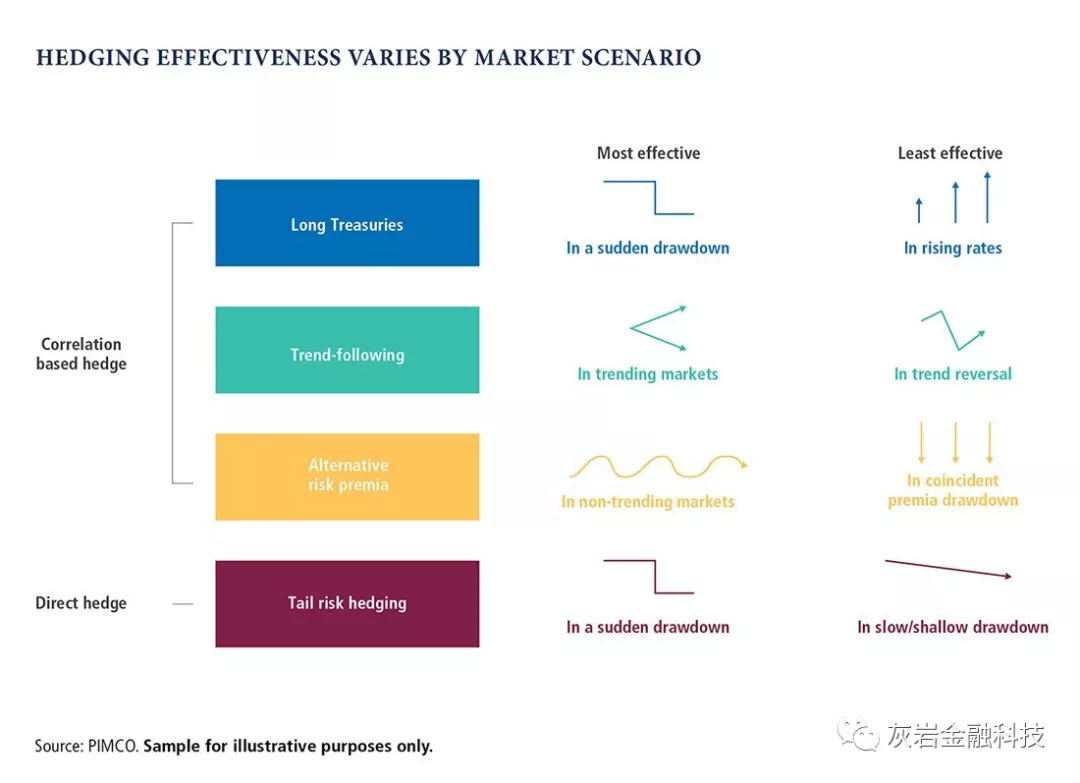

This article proposes tail risk hedging (TRH) as an alternative model for managing risk in investment portfolios. The standard risk management approach involves a significant allocation to hiqh-quality bonds. However, this approach has historically reduced expected returns over the long term (see article here and PDF available here). Accordingly, it could be sensible to pursue an alternative approach by managing equity risk directly, rather than avoiding or reducing it – thereby allowing investors to maintain higher overall equity allocations, which tend to deliver higher expected returns.

本文提出尾部风险对冲(TRH)作为管理投资组合风险的替代模型。标准风险管理方法涉及对高质量债券的重大分配。然而,这种方法在历史上长期降低了预期回报(参见此处的文章和PDF文件)。因此,通过直接管理股权风险而不是避免或减少股权风险来寻求替代方法是明智的 - 从而允许投资者维持更高的总体股票分配,这往往会带来更高的预期回报。

But how can one manage equity risk directly? Answer: market timing…I know, I know…a bad word in the world of investing but hear me out.

但是如何直接管理权益类资产的风险呢?答案:市场择时......我知道,我知道......在投资领域这是一个坏话,但是请听我详细说明。

Market timing has rightfully been associated with poor investment performance in many situations. In my view, however, much of this underperformance can be attributed to inefficient implementations that involve uncomfortable tracking error (i.e., watch markets continue higher from the sidelines).

在许多情况下,市场时机恰恰与投资业绩不佳有关。然而,在我看来,这种表现不佳的大部分可归因于涉及不舒服的跟踪误差的低效实施(即,观望市场从边线继续走高)。

Instead of making wholesale changes to a portfolio, a tail risk (a.k.a. black swan) strategy might only comprise a 1-5% allocation. However, these positions would embed significant leverage to amplify their impact. Like card counting in blackjack, these strategies should only be employed opportunistically (i.e., when markets are vulnerable to tail risk). Moreover, their risk/reward profile should be extremely asymmetric with limited downside but significant upside potential (i.e., measured in multiples instead of percent returns).

尾部风险(即黑天鹅)策略可能仅包含1-5%的分配,而不是对投资组合进行批量更改。但是,这些立场将有很大的影响力来扩大其影响力。就像二十一点中的卡片计数一样,这些策略应该只在机会上使用(即,当市场容易受到尾部风险时)。此外,他们的风险/回报概况应该是非常不对称的,具有有限的下行但具有显着的上行潜力(即,以倍数而不是百分比回报来衡量)。

Interestingly, I believe equity derivatives markets (e.g., put options, VIX products, etc.) could offer attractive risk/reward opportunities due to price distortions resulting from the popularity of short-volatility products.(1)

有趣的是,我认为股票衍生品市场(例如看跌期权,VIX产品等)可能会因短期波动性产品的普及而导致价格扭曲,从而提供具有吸引力的风险/回报机会。(1)

Figure 1: Allocate Capital According to the Attractiveness of the Opportunity

Source: Aaron Brask Capital

Overview

Tail risk hedging (TRH) strategies are effectively geared to profit from significant market corrections. They may be used alongside, or to replace, traditional risk management strategies (e.g., diversification via asset allocation) where the core portfolios have a significant allocation to equities or other volatile assets. They may also be used on a standalone basis to speculate and profit from market corrections (think The Big Short). We briefly discuss various applications at the end of this article.

总览

尾部风险对冲(TRH)策略有效地适应重大市场调整的利润。它们可以与传统风险管理策略(例如,通过资产分配实现多样化)一起使用或替代,其中核心投资组合对股票或其他易变资产进行重大分配。它们也可以单独使用,以推测并从市场调整中获利(想想The Big Short)。我们将在本文末尾简要讨论各种应用程序。

Before delving into the details of TRH strategies, I first discuss the traditional approach to managing risk within investment portfolios. I then explain some of the vagaries associated with the often ill-fated strategy of market timing.

在深入研究TRH策略的细节之前,我首先讨论了管理投资组合中风险的传统方法。然后我解释一些与市场时机常常命运多动的策略相关的变幻莫测。

It is worth noting the TRH strategies discussed here are based on the equity and equity derivatives markets. However, I have also made a comparison to some of the speculative credit derivative strategies used to profit from the collapse of the housing bubble approximately 10 years ago.

值得注意的是,这里讨论的TRH策略是基于股票和股票衍生品市场。不过,我还对大约10年前房地产泡沫破灭所带来的一些投机性信贷衍生策略进行了比较。

Diversification via Asset Allocation

The conventional approach to managing portfolio risk typically involves diversifying investments amongst various asset classes. If the assets are not perfectly correlated, this will naturally mitigate the impact of a significant decline in any one asset class. At the same time, it will also dilute the upside potential of higher growth asset classes.

通过资产配置实现多元化

管理投资组合风险的传统方法通常涉及在各种资产类别之间分散投资。如果资产不完全相关,这自然会减轻任何一个资产类别显着下降的影响。与此同时,它也将削弱更高增长资产类别的上行潜力。

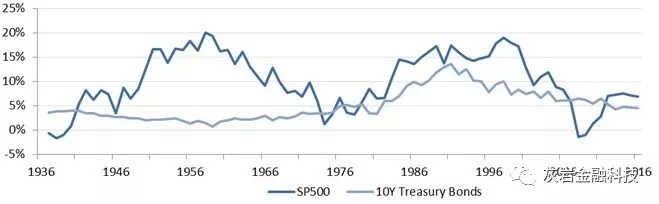

For example, consider a standard portfolio comprised of just stocks and bonds. Stocks have historically outperformed bonds by a significant amount over longer time periods (i.e., multiple percents per year). So the performance of portfolios with larger allocations to bonds have tended to lag those with smaller or no bond allocations. Indeed, when looking at rolling 10-year windows since the start of the Great Depression, stocks outperformed bonds 84% of the time. Moreover, the windows where stocks lagged bonds for a decade or more were clearly clustered around periods where stocks started with extremely high valuations (like now). I discuss the drivers behind these historical trends in more detail in my Asset Allocation article.

例如,考虑一个仅由股票和债券组成的标准投资组合。历史上,股票在较长时期内(即每年多重百分比)的表现优于债券。因此,对债券进行较大分配的投资组合的表现往往落后于债券分配较小或没有债券分配的投资组合。事实上,从大萧条开始以来,当看到滚动的10年窗口时,股票在84%的时间里表现优于债券。此外,股票在十年或更长时间内落后债券的窗口显然聚集在股票开始时具有极高估值的时期(如现在)。我在资产分配文章中更详细地讨论了这些历史趋势背后的驱动因素。

Figure 2: 10-year Rolling Returns

Source: Standard and Poor’s, Federal Reserve Board, The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

资料来源:标准普尔,联邦储备委员会,结果是假设结果,不是未来结果的指标,也不代表任何投资者实际获得的回报。 索引是不受管理的,不反映管理或交易费用,也不能直接投资于索引。 有关构建这些结果的其他信息可根据要求提供。

Many investors (professional and retail) implement diversification via fixed asset allocations through time. That is, they maintain their percentage allocations to various asset classes via periodic rebalancing. This approach is fairly standard within the investment management industry. However, in some situations, I believe the fixed asset allocation approach might be better characterized by risk avoidance than risk management. Indeed, it systematically reduces stock exposures.(2)

许多投资者(专业和零售商)通过固定资产分配实现多样化。也就是说,他们通过定期重新平衡来维持各种资产类别的百分比分配。这种方法在投资管理行业中是相当标准的。但是,在某些情况下,我认为固定资产分配方法可能比风险管理更能表现为避免风险。实际上,它系统地减少了库存风险。(2)

This leads to the challenge of how to manage equity risk without having to avoid equities. One answer is to ensure the portfolio against market losses via put options. I discuss this and other strategies in the TRH section, but the bottom line is put options are very expensive and this typically results in a net-negative result over the long term (see here for a conversation on this topic). Another option is to step out of the equity markets at times when risks are high. This is known as market timing and is the focus of the following section.

这导致了如何在不必避免股票的情况下管理股票风险的挑战。一个答案是通过看跌期权确保投资组合免受市场损失。我在TRH部分讨论了这个和其他策略,但是底线是选项非常昂贵,这通常会导致长期的净负面结果(请参阅此处有关此主题的对话)。另一种选择是在风险很高的时候走出股市。这被称为市场时机,是以下部分的重点。

The Painful and Rarely Successful Strategy of Market Timing

It is virtually impossible to pick the absolute tops or bottoms of markets, or as Wes says, “Unicorns don’t exist, and neither do high returns with low risk.” Asset prices are only loosely attached to their underlying fundamentals. There is a myriad of factor influencing this linkage between fundamentals and market prices. Here I discuss how the perceptions and competing interests of different investors result in a layer of noise around market prices and thereby make market forecasting more difficult. I also discuss several practical challenges to implementing marketing timing strategies.

痛苦而极少成功的市场时机策略

选择市场的绝对顶部或底部几乎是不可能的,或者正如Wes所说,“独角兽不存在,低风险也没有高回报。”资产价格只是松散地依附于其基本面。影响基本面与市场价格之间联系的因素有很多。在这里,我将讨论不同投资者的看法和竞争利益如何导致围绕市场价格的一层噪音,从而使市场预测更加困难。我还讨论了实施营销时间策略的几个实际挑战。

Different Risk Profiles

Every investor has a different perspective and approach to investing. For example, younger investors may be more inclined to own stocks than older investors who have little appetite to risk put their retirement funds at risk. Moreover, every investor has a unique risk profile. Whether it is their natural personality or a particular investment experience (e.g., tech or housing bubble, scam or fraud, etc.), risk profiles are shaped by a variety of factors and can change through time.

不同的风险简介

每个投资者都有不同的投资观点和方法。例如,年轻投资者可能更倾向于拥有股票而不是那些没有风险偏好风险的老投资者将退休基金置于风险之中。此外,每个投资者都有独特的风险状况。无论是他们的自然个性还是特定的投资经历(例如,技术或房屋泡沫,骗局或欺诈等),风险概况都受到各种因素的影响,并且可能随时间而变化。

Even when investors have similar risk profiles, they may interpret investments differently. There are competing investment philosophies (e.g., active versus passive), different investment and valuation models, and every investor has a unique educational background with respecting to investing. Take evidence-based investing, for example. One might think that investment professionals who are dedicated to analyzing investments and strategies in a scientific manner would arrive at similar conclusions. This is not that case. Different people interpret the same data differently.

即使投资者具有相似的风险概况,他们也可能以不同方式解释投 存在竞争性投资理念(例如,主动与被动),不同的投资和估值模型,并且每个投资者在投资方面都具有独特的教育背景。例如,以证据为基础的投资。有人可能会认为致力于以科学方式分析投资和战略的投资专业人士会得出类似的结论。事实并非如此。不同的人对同一数据的解释不同。

Last but not least, emotions and behavioral biases can trump all of the data and analysis in the world. Whether investors are aware of their own tendencies or not, behavioral psychology has now become a major focal point for many investors, investment professionals, and academics due to its significant impact on investors. Given the inherent fickleness of human nature, this inserts yet another layer of detachment between fundamentals and market prices. Emotions are not based on rational thought but impulses and instincts. Accordingly, attempting to predict the emotional component of investor behaviors is tantamount to predicting irrational behaviors. While Dan Ariely (author of Predictably Irrational) might disagree, this is virtually impossible. Investors can change their moods in an instant and this injects additional noise into market prices.

最后但并非最不重要的是,情绪和行为偏见可以胜过世界上所有的数据和分析。无论投资者是否意识到自己的倾向,行为心理学现已成为许多投资者,投资专业人士和学者的主要焦点,因为它对投资者有重大影响。鉴于人性固有的变幻无常,这又在基本面和市场价格之间插入了另一层分离。情绪不是基于理性思考,而是基于冲动和本能。因此,试图预测投资者行为的情感成分等于预测非理性行为。虽然Dan Ariely(Predictably Irrational的作者)可能不同意,但实际上这是不可能的。投资者可以立即改变他们的情绪,这会给市场价格注入额外的噪音。

In a nutshell, market prices are subject to a broad spectrum of investor choices that lead to buying and selling decisions. It is virtually impossible to time with great precision when market perceptions or moods will change. For this reason, attempting to forecast the timing of major market turns can be a challenging endeavor.

简而言之,市场价格受到广泛的投资者选择的影响,导致买卖决策。当市场观念或情绪发生变化时,几乎不可能非常准确地计时。出于这个原因,试图预测主要市场转变的时机可能是一项具有挑战性的努力。

In Practice

Even if one is reasonably competent in forecasting these seismic shifts in markets, it is still very difficult to successfully benefit from market timing. For example, many portfolios are taxable. So if an investor wishes to reduce exposures to equities, it will likely incur capital gains taxes. The precise amount of tax friction will depend upon the basis or unrealized gains embedded in an equity portfolio. For investors with tax-deferred accounts (e.g., 401K or IRA), this is a non-issue. Taxes aside, there will likely be transaction costs for selling existing positions (and rebuying them or other assets later). Given the low-cost brokerage options investors have today, these costs can be minimized.

在实践中

即使一个人能够合理地预测市场中的这些地震变化,仍然很难成功地从市场时机中受益。例如,许多投资组合都是应纳税的。因此,如果投资者希望减少对股票的敞口,它可能会产生资本利得税。税收摩擦的确切数额将取决于股票投资组合中的基础或未实现收益。对于有延税账户的投资者(例如401K或IRA),这不是问题。除税外,出售现有头寸(以及稍后重建或其他资产)可能会产生交易成本。鉴于投资者目前的低成本经纪选择,这些成本可以降至最低。

A perhaps more important issue with market timing is the emotional toll it can take on an investor. I have already discussed the virtual impossibility of getting the timing perfect. Assuming one has pulled money out of equities, this means there would be a period where markets continue higher but the investor does not participate. This situation can create significant doubt and discomfort (also a potential source of premium). That is, being right but too early can result in the painful feeling of lost opportunity.

市场时机可能更重要的一个问题是它可能对投资者造成的情感损失。我已经讨论过让时间完美的虚拟不可能性。假设有人从股票中掏钱,这意味着市场会继续走高,但投资者不会参与。这种情况可能会产生很大的疑虑和不适(也是潜在的溢价来源)。也就是说,正确但过早可能导致失去机会的痛苦感觉。

Between the challenges involved in profitably executing this type of market timing strategy and the potential emotional discomfort, it is no surprise this practice is frowned upon by many investors and investment professionals. Making wholesale changes to a portfolio is perceived as an aggressive strategy – even if vindicated in the end. Thus it opens up the door to job risk as it requires an advisor to stick their neck out and invest differently. Status quo is much safer (for the advisor).

在有利于执行这种类型的市场时机策略所带来的挑战和潜在的情绪不适之间,这种做法在许多投资者和投资专业人士的赞同下并不令人惊讶。对投资组合进行批发变更被认为是一种积极的策略 - 即使最终被证明是正确的。因此,它为工作风险打开了大门,因为它需要顾问坚持不懈地进行投资。现状更安全(对于顾问)。

Tail Risk Hedging (TRH)

Whether one is reducing their equity exposure permanently via a fixed asset allocation or temporarily in the context of market timing, it affects the composition of the overall portfolio. However, TRH (a.k.a. black swan) strategies are typically concentrated within a smaller allocation comprising less than 5% of the overall portfolio. This allows one to retain 95% or more of their standard portfolio exposures. Specifically, this helps avoid the potential emotional rollercoaster associated with wholesale changes to the portfolio (i.e., reducing equity exposure and watching markets go up from the sidelines).

尾部风险套期保值(TRH)

无论是通过固定资产配置永久性地减少其股权风险还是暂时在市场时机背景下,它都会影响整个投资组合的构成。然而,TRH(a.k.a。黑天鹅)策略通常集中在较小的分配中,占总体投资组合的不到5%。这允许人们保留95%或更多的标准投资组合风险。具体而言,这有助于避免与投资组合的批发变更相关的潜在情绪过山车(即,减少股票敞口并观察市场从观望中上升)。

So how can such a small allocation help mitigate risks at the portfolio level? That is the $64,000 question. The obvious answer is that these positions would embed significant leverage to amplify their impact. While this is true, the real value of TRH strategies is derived from the efficiency with which they provide these leveraged upside payoffs. In other words, the cost side of the equation must be minimized relative to the upside. In my view, there are three primary factors driving this efficiency which I discuss below.

那么这么小的分配如何帮助降低投资组合层面的风险呢?那是64,000美元的问题。显而易见的答案是,这些立场将有很大的影响力来扩大其影响力。虽然这是事实,但TRH策略的真正价值来自于它们提供这些杠杆上行收益的效率。换句话说,方程的成本方面必须相对于上方最小化。在我看来,有三个主要因素推动了这种效率,我将在下面讨论。

Precise Risk Targeting

When it comes to markets, there is a tremendous amount of noise relative to the underlying signal. For example, long-term US stock market returns have been around 10% but volatility has been almost twice as high – averaging just over 20%.

From a TRH perspective, capturing the noise of short-term market movements is not the primary goal. We want to identify and isolate the underlying signal we want to hedge – in this case being a large downside move in the equity market. This would not happen overnight; it would likely take the better part of a year or longer. In terms of tools for hedging, this would translate into options and derivative products with maturities of at least one year.

精确的风险定位

就市场而言,相对于基础信号存在巨大的噪音。例如,美国长期股票市场的回报率约为10%,但波动率几乎是其两倍 - 平均只有20%以上。

从TRH的角度来看,捕捉短期市场走势的噪音并非主要目标。我们希望识别并隔离我们想要对冲的潜在信号 - 在这种情况下,股票市场是一个很大的下行动作。这不会在一夜之间发生; 它可能需要一年或更长的时间。在套期保值工具方面,这将转化为期限至少为一年的期权和衍生产品。

There are other benefits related to using longer-term derivatives. For starters, multiple short-term options generally cost more than similar long-term options. However, the more important point, in my view, is that longer-dated derivatives also embed expectations about the future (e.g., implied volatility). That means we do not necessarily have to capture the entire downside move we are trying to hedge because our positions may capture changes in market perception as well. For example, consider a two-year at-the-money (ATM) put option. If the market started to correct, then we would naturally benefit from the downside move as the option would be further in-the-money (ITM). However, we would also benefit from the increase in implied volatility (higher probability of a larger payoff – assuming the put was not too far ITM).

使用长期衍生工具还有其他好处。对于初学者来说,多个短期期权的成本通常高于类似的长期期权。然而,在我看来,更重要的一点是较长期的衍生品也嵌入了对未来的预期(例如隐含波动率)。这意味着我们不一定要抓住我们试图对冲的整个下行动作,因为我们的头寸也可能捕捉到市场认知的变化。例如,考虑一个为期两年的平价(ATM)看跌期权。如果市场开始纠正,那么我们自然会受益于下跌趋势,因为期权将进一步在价内(ITM)。然而,我们也会受益于隐含波动率的增加(更高收益的概率更高 - 假设看跌期权并不太远ITM)。

Another factor in making hedges more precise is to avoid hedging unlikely outcomes. For example, if one thinks a correction of 50% is possible but not 75%, it would be sensible to purchase put options struck around 50% but then sell puts truck around 25% (i.e., strikes as a percentage of current market levels). However, if the intention is for a hedge to benefit from changes in market perception, one should be aware that the derivatives market may place a higher probability on what you view as unlikely outcomes.

使对冲更精确的另一个因素是避免对冲不可能的结果。例如,如果一个人认为50%的修正是可能的而不是75%,那么购买看跌期权约为50%是明智的,然后出售卡车约25%(即罢工占当前市场水平的百分比)。但是,如果目的是使对冲从市场认知的变化中受益,那么应该意识到衍生品市场可能会将您认为不太可能的结果的概率提高。

Interestingly, derivative pricing models are essentially ignorant of fundamentals. That is, most pricing models are based on market price information (e.g., price and volatility). This can create opportunities (Berkshire Hathaway’s put sale comes to mind) but can also impose challenges in the context of TRH strategies. It is important to be aware of these issues as they can make all the difference when it comes to successfully (profitably!) executing TRH strategies. Otherwise, it is very possible mark-to-market risk can translate into liquidity issues.

有趣的是,衍生品定价模型基本上不了解基本面。也就是说,大多数定价模型基于市场价格信息(例如,价格和波动率)。这可以创造机会(伯克希尔哈撒韦公司的销售情况浮现在脑海中),但也可以在TRH战略的背景下提出挑战。重要的是要意识到这些问题,因为它们可以在成功(有利可图!)执行TRH策略时发挥重要作用。否则,盯市风险很可能转化为流动性问题。

Timing

This section could arguably be integrated into the previous section in the sense that timing the strategy is the same as being precise but in the temporal domain. That is, you only hedge tail risk when it is present.

择时

可以说,本节可以被整合到上一节中,即策略的时间安排与精确但在时间域中相同。也就是说,只有当它存在时才能对冲尾部风险。

Consider the game of blackjack. If you are a skilled card counter, then you will size your bets according to the odds of winning based on the remaining cards in the deck(s). In the context of markets, you would only execute TRH strategies when markets were vulnerable to significant corrections. In my view, this is when valuations are very high (like now).

考虑二十一点游戏。如果您是一个熟练的荷官,那么您将根据获胜的几率根据牌组中剩余的牌来确定您的赌注大小。在市场背景下,当市场容易受到重大修正时,您只会执行TRH策略。在我看来,这是估值非常高的时候(就像现在一样)。

The insurance business provides another analogy; it is generally profitable business. What does this mean for an investor who constantly hedges their portfolios? Underperformance is likely as they are likely paying a premium for the insurance. However, if one is only opportunistically hedging, say, one-third of the time, then this translates into a significant reduction in the cost of insurance.

保险业提供另一种类比; 它通常是一项有利可图的业务。这对于经常对冲投资组合的投资者意味着什么?表现不佳可能是因为他们可能会为保险支付溢价。但是,如果一个人只是机会性地进行套期保值,比如三分之一的时间,那么这就意味着保险费用的显着降低。

It is also worth noting the derivatives markets have a tendency to price risk (options and implied volatility) according to trailing observations (realized volatility). That means the cost of hedging often will go up after the risk has surfaced but can be cheap when it is most needed. The bottom line is that it is sensible to the only hedge when risk is high.

值得注意的是,衍生品市场倾向于根据尾随观察(实现的波动率)定价风险(期权和隐含波动率)。这意味着套期保值的成本通常会在风险浮出水面后上涨,但在最需要的时候可能会很便宜。最重要的是,当风险很高时,只有对冲是明智的。

The Cost of Certainty

Another dimension of hedging relates to how well a hedge must protect against a specific risk. For example, a put is a direct and structural hedge for broad market exposure. In other words, the payoff is formulaic. This leaves minimal, if any, uncertainty with regards to the risk being hedged.

确定性成本

套期保值的另一个方面涉及套期保值对抗特定风险的程度。例如,看跌期权是广泛市场风险的直接和结构性对冲。换句话说,收益是公式化的。对于被套期保值的风险,这留下了最小的(如果有的话)不确定性。

For comparison, consider a hedge whereby one takes a long volatility position instead of purchasing a put. Given that volatility has historically been strongly correlated with market sell-offs, this would likely provide a hedge against market declines. However, the payoff is not formulaically linked to the percentage decline. In fact, it could be possible for a market correction to take place gradually without much volatility. In this scenario, the volatility position would not provide a good hedge whereas the put would have. I view this situation as unlikely and believe the correlation (market declines/volatility) will persist.

为了进行比较,考虑一种对冲方式,即持有多头波动性而不是买入看跌期权。鉴于波动率历来与市场抛售密切相关,这可能会对市场下跌构成对冲。然而,收益与下降百分比没有公式联系。事实上,市场调整有可能逐渐发生而没有太大波动。在这种情况下,波动性头寸不会提供良好的套期保值,而看跌期权。我认为这种情况不太可能,并认为相关性(市场下跌/波动性)将持续存在。

In my experience, the demand for puts as the crème de la crème of hedging tools results in a persistent price premium of these options. Accordingly, it may be possible to utilize a robust but not formulaic hedge at a lower cost. One should be careful in using such hedges and ensure their payoffs are very likely to correlate with the risk being hedged. If done sensibly, these probabilistic (i.e., non-formulaic) hedges may be more efficient and thus provide a potentially higher upside relative to their costs.

根据我的经验,对套期保值作为套期保值工具的需求导致这些期权的持续溢价。因此,可以以较低的成本利用稳健而非公式化的套期保值。人们应该谨慎使用这种对冲,并确保他们的收益很可能与被套期保值的风险相关联。如果合理地完成,这些概率(即,非公式化)对冲可能更有效,因此相对于其成本提供潜在更高的上行。

Potential Products for Tail Risk Hedging

Below I provide a brief overview of some of the more popular products that might be used for TRH strategies. I then summarize some of the general differentiating factors between these concepts.(3)

尾部风险套期保值的潜在产品

下面我简要介绍一些可能用于TRH策略的更受欢迎的产品。然后,我总结了这些概念之间的一些一般区别因素。(3)

Puts: As discussed above, puts are the most direct hedge for insuring a portfolio against a market crash. There are puts available linked to a variety of popular investment indices (e.g., S&P 500 or Dow Jones Industrial Average) as well as the ETFs that replicate those indices. They are typically available across a wide spectrum of strikes and maturities. More customized puts (e.g., on a particular basket of stocks) are available in the OTC markets.

认沽期权(看跌期权):如上所述,看跌期权是确保投资组合抵御市场崩盘的最直接对冲。有各种热门投资指数(例如标准普尔500指数或道琼斯工业平均指数)以及复制这些指数的ETF。它们通常可用于各种罢工和期限。在OTC市场上可以获得更多定制的看跌期权(例如,在特定的一篮子股票上)。

Delta-hedged options: While purchasing puts and holding them directly hedges against market declines, investors could also delta hedge their long options positions in order to gain long exposure to volatility. Readers interested in learning more about these strategies can read the appendix on volatility trading in my Zombie Market Primer article (blog post and PDF version). This is a strategy that is likely too technical for most investors to implement on their own. However, this is why the industry created products to provide volatility exposures that do not require the hassle of delta hedging.

德尔塔对冲期权(中性策略,对冲掉标的物价格变化速度对期权价格的影响):在购买看跌期权并直接对冲市场下跌时,投资者还可以对其长期期权头寸进行德尔塔的敞口进行对冲,以获得长期波动性。 对于大多数投资者而言,这种策略可能过于技术化而无法自行实施。然而,这就是为什么该行业创造产品以提供不需要三角洲对冲麻烦的波动风险的原因。

Volatility products: The Chicago Board Options Exchange (CBOE) has developed a variety of products based on volatility-based payoffs. There are futures which effectively provide linear exposure to the VIX at a future point in time. It is important to understand these products settle to a future value of the VIX which itself embeds future expectations of market volatility. In other words, investors who purchase or sell these futures are speculating on the difference between the current and future level of implied volatility as calculated by the VIX methodology.

波动率产品:芝加哥期权交易所(CBOE)开发了多种基于波动率支付的产品。有未来有效地在未来的时间点提供线性风险。重要的是要了解这些产品是否符合VIX的未来价值,而VIX本身嵌入了市场波动的未来预期。换句话说,购买或出售这些期货的投资者正在推测VIX方法计算的当前和未来隐含波动率水平之间的差异。

There are also futures on realized volatility. Technically, they have realized variance futures (variance = volatility squared). These settle to the difference between the current level of implied variance and the actually realized variance.

金融市场也有基于波动性的期货合约。从技术上讲,他们实现了方差期货(方差=波动率平方)。这些结果归结为当前隐含方差水平与实际实现方差之间的差异。

Realized variance futures are very different from VIX futures because there is no further expectation baked into realized variance futures when they settle; they are determined precisely by the historical price data of the index. If volatility were to spike right before expiry, it may contribute very little to the payoff since it is just one day of realized volatility. On the other hand, expectations of higher volatility in the future would be captured by VIX futures since they settle to an implied figure (the level of the VIX at settlement) that might reflect expectations for higher volatility in the future based on the recent realized volatility.

实现的方差期货与VIX期货非常不同,因为当它们结算时没有进一步的预期被实现的方差期货; 它们完全由指数的历史价格数据决定。如果波动率在到期前飙升,则可能对收益贡献很小,因为它只是实现波动的一天。另一方面,VIX期货将对未来波动性较高的预期产生影响,因为它们将结算为隐含数据(结算时的波动率水平),这可能反映出基于近期实现的波动性对未来波动性较高的预期。

The other obvious and important distinction is that variance payoffs can provide much larger upside relative to volatility-based payoffs. However, there are also options available on the VIX which can provide additional leverage. Readers interested in more technical details may refer to my Zombie Market Primer article referenced above or my older but more technical article describing VIX products.

另一个明显而重要的区别是,相对于基于波动率的收益,方差收益可以提供更大的上行空间。但是,VIX上还有一些选项可以提供额外的杠杆作用。

Product Dynamics

The payouts for the above derivative products are all different and offer investors a variety of choices for hedging (or other applications). Each product has advantages and disadvantages depending on one’s goals. It is important to understand both the ultimate payout at expiration and the potential mark-to-market impacts. The latter is critical for the many cases where derivatives positions are not held until expiration.

金融合约产品的动态

上述衍生产品的支出各不相同,为投资者提供了多种对冲(或其他应用)选择。根据一个人的目标,每种产品都有优点和缺点。重要的是要了解到期时的最终支付和潜在的按市值计价的影响。后者对于衍生品头寸在到期前不会持有的许多情况至关重要。

In most hedging applications, the value of the hedges decays through time unless the market declines or the potential for a decline has increased. The rate of decay is linked to the amount of time until the expiration and the potential upside for the payout. More time means more things could happen (i.e., more time for risk to the surface). This generally translates into more expensive hedges (e.g., 1-year put versus 1-month put).

在大多数对冲应用中,除非市场下跌或下跌的可能性增加,否则套期保值的价值会逐渐衰减。衰退率与到期前的时间量和支付的潜在上行空间有关。更多的时间意味着可能发生更多的事情(即,更多时间表面上的风险)。这通常转化为更昂贵的对冲(例如,1年投入与1个月投放)。

Intuitively, one might think of risk as scaling with the square root of time. If you look at the price of one-year versus 4-year ATM puts, you will likely see the latter is approximately twice the price of the former (square root of 4 equal 2). I am leaving out some details (forward versus spot ATM, volatility surfaces, money-ness, etc.), but this is a fair characterization of risk scaling. Indeed, if you look at most derivatives pricing formulae, you will see volatility parameters followed by the square root of time (e.g., or ).

直觉上,人们可能会认为风险是随时间的平方根缩放的。如果你看一年期与四年期ATM机的价格,你可能会看到后者的价格大约是前者的两倍(4的平方根等于2)。我遗漏了一些细节(前向与现货平价合约ATM,波动率表面,货币等),但这是对风险规模的公平表征。实际上,如果你看一下大多数衍生品定价公式,你会看到波动率参数后跟时间的平方根(例如,或)。

While longer expirations may be more expensive on an absolute basis, they are typically cheaper to carry. This is because each day that passes is relatively less impactful for longer expiration products. This should be evident just by observing the single day passing as the percentage of time that is lost. However, it is deeper than that. If you assume risk scales with the square root of time and plot it on a chart with time on the x-axis, then you will see how the curve accelerates toward zero when moving from left to right. Technical details aside, the bottom line is that longer expiration derivatives can be cheaper to hold. This is a critical consideration when executing TRH strategies and balancing potential upside with costs to get the most bang for your buck.

虽然较长的到期可能在绝对的基础上更昂贵,但它们通常携带更便宜。这是因为通过的每一天对于较长的过期产品影响相对较小。这一点应该通过观察单日传递作为失去的时间百分比来证明。但是,它比那更深。如果您假设风险标度具有时间的平方根并将其绘制在图表上,并且时间在x轴上,那么您将看到当从左向右移动时曲线如何加速到零。除了技术细节之外,最重要的是较长的到期衍生品可以更便宜地持有。这是执行TRH策略和平衡潜在上行成本以获得最大收益的关键考虑因素。

Example:

Consider the scenario where I hedge with 1-year ATM put options on the SPY ETF but roll it every six months (i.e., when the 1-year option has become a 6-month option). Moreover, let us assume markets uneventfully move sideways over the six months. Based on my rudimentary risk scaling approximation above, this 1-year ATM put option will lose approximately 30% of its value of those six months (square root of one minus the square root of 0.5). Looking at current pricing (as of 2:52 pm EST September 7, 2017), mid-market prices for approximately 1-year and 6-month ATM puts are $14.27 and $9.05, respectively. This indicates a decay of 37% in the price of the option over those six months. This is not exactly the 30% I estimated, but in the right ballpark.

举例来说:

考虑我在SPY ETF上对冲1年期ATM看跌期权的情况,但是每六个月进行一次滚动(即1年期权变为6个月期权)。此外,让我们假设市场在六个月内平稳地横向移动。根据我上面的基本风险比例近似值,这1年期ATM看跌期权将失去其六个月价值的约30%(平方根除以0.5的平方根)。从目前的价格来看(截至2017年9月7日美国东部时间下午2:52),大约1年期和6个月ATM点的中间市场价格分别为14.27美元和9.05美元。这表明该期权价格在这六个月内贬值了37%。这不是我估计的30%,而是在正确的球场。

On the flip side, we can use a similar approximation to figure out what the breakeven for volatility would be in such a scenario. That is, in order to compensate for the loss in time value, how much higher would volatility have to go to breakeven? The current implied volatility for the 1-year ATM put option is approximately 15%. All else equal, the 37% loss due to time decay would require volatility to increase by a factor of 1.59x (1 ÷ 63%) to just about 24% for breakeven. However, all else is not equal. If volatility were to rise significantly, it would very likely involve a market decline which would further increase the value of the put option. Accordingly, the 24% breakeven for implied volatility is a very conservative (high) estimate.

另一方面,我们可以使用类似的近似来计算在这种情况下波动性的盈亏平衡。也就是说,为了弥补时间损失的价值,波动性需要多少才能达到盈亏平衡?1年ATM看跌期权的当前隐含波动率约为15%。在其他条件相同的情况下,由于时间衰减导致的37%损失将需要波动性增加1.59倍(1÷63%)至盈亏平衡的约24%。但是,其他一切并不相同。如果波动性显着上升,很可能会导致市场下跌,从而进一步增加看跌期权的价值。因此,隐含波动率的24%盈亏平衡是一个非常保守(高)的估计。

The Big Short: A Comparison

In my view, equity derivatives markets can offer compelling opportunities for TRH strategies. For a variety of reasons I have highlighted in previous articles, investors have elevated valuations for US equities. In my view, this alone provides an impetus to look at risk management or hedging strategies. However, the cost of hedging has also been artificially dampened due to the popularity and self-perpetuating nature of low- and short-volatility strategies.

大空头:比较

在我看来,股票衍生品市场可以为TRH策略提供令人信服的机会。 由于我在之前的文章中强调的各种原因,投资者对美国股票的估值升高。 在我看来,这仅仅是推动风险管理或对冲策略的动力。 然而,由于低波动率和短波动率策略的普及和自我延续性,套期保值的成本也被人为地削弱。

For example, mid-market pricing currently implies the probability of a 50% collapse over the next year and half is about 3%. If one purchased the appropriate options at these prices and this (50% correction) occurred, investors speculating on this collapse would turn $3 into $100 – a multiple of 33x their original investment. However, mid-market pricing is not likely. Bid-ask spreads have widened since August of last year (when this article was originally published) and the cost of executing across the bid-ask spreads is approximately double. So this would cut the upside potential in half. Suffice to say, execution is key for strategies involving less liquid instruments.

例如,中间市场定价目前意味着明年50%崩溃的可能性,一半约为3%。如果以这些价格购买了适当的期权并且发生了这种情况(50%修正),那么投机者猜测这次崩盘将使3美元变成100美元 - 这是原始投资的33倍。但是,中端市场定价不太可能。自去年8月(本文最初发布)以来,买卖差价已经扩大,并且买卖价差的执行成本大约是两倍。因此,这将把上行潜力减半。可以说,执行是涉及流动性较低的工具的战略的关键。

Notwithstanding execution issues, speculating specifically on a 50% decline is a risky proposition. Indeed, a decline of 49% might result in a zero payoff. Moreover, many TRH strategies would likely decay significantly before they paid off. So the payoff multiple might be applied to a smaller capital base (original investment minus time decay). In practice, payoffs could be higher or lower (and possibly a loss) depending upon the TRH strategy employed. On balance, even when taking decay and other variables into account, I believe tail risk is still underestimated by many derivative products and attractive opportunities are available where returns are better measured in multiples rather than percent.

尽管存在执行问题,但专门针对50%的下降进行推测是一个冒险的主张。实际上,下降49%可能会导致零收益。此外,许多TRH策略可能会在它们获得回报之前显着衰减。因此,支付倍数可能适用于较小的资本基础(原始投资减去时间衰减)。在实践中,取决于所采用的TRH策略,收益可能更高或更低(并且可能是损失)。总的来说,即使考虑到衰变和其他变量,我认为许多衍生产品仍然低估了尾部风险,并且有很多有吸引力的机会,其中回报更好地以倍数而非百分比来衡量。

Having said this, I do not believe the TRH opportunities highlighted above are as attractive as those found in the credit (derivative) markets prior to the credit crisis fully exploded. At the time, one could purchase credit default swaps on various investment-grade collateralized debt obligation (CDO) tranches for less than 50 bps per year where that price was fixed for five years. In other words, you could have risked $0.50 a year to earn $100 (if the CDO tranche went to zero) over a five-year period. While there could be some decay and mark-to-market risk, the potential payoff could be as high as 200x the original investment ($0.50 turned into $100). Even if it took five years and the value of the tranche only fell by 50% (i.e., a recovery rate of 50%), you still would have reaped a payoff multiple of 20x ($50 payoff ÷ $2.50 investment). In reality, the value of many CDO tranches did go to zero and the cost of protection was actually closer to $0.30 than $0.50 making for potential payout multiples as high as 333x.

话虽如此,我不相信上面强调的TRH机会与信贷危机爆发之前信贷(衍生)市场中发现的机会一样具有吸引力。当时,人们可以购买各种投资级抵押债务债券(CDO)的信用违约掉期,每年低于50个基点,而该价格固定为五年。换句话说,在五年期间,你可能每年冒险赚0.5美元(如果CDO部分为零)。虽然可能存在一些衰退和盯市风险,但潜在的回报可能高达原始投资的200倍(0.50美元变成100美元)。即使用了五年而且该部分的价值仅下降了50%(即50%的回收率),您仍然可以获得20倍的支付倍数(50美元的回报÷2.50美元的投资)。实际上,许多CDO部分的价值确实为零,保护成本实际上接近0.30美元而不是0.50美元,这使得潜在支付倍数高达333倍。

The above multiples only refer to the ultimate payout. As mentioned above, it is also important to consider the mark-to-market perspective many investors experiences. Investors who viewed these strategies through the same prism they would use for most other investments were probably extremely uncomfortable. Indeed, observing a hedge fund decline by 10-20% typically earns the investment managers a few phone calls and meetings to explain the underperformance. However, with these CDO strategies, even 2-3 basis point changes in the CDS pricing could easily result in swings of greater than 20% depending upon the leverage employed. This is one reason it is important to understand the dynamics of TRH strategies and avoid getting caught off-guard. This mark-to-market pain was depicted by many of the hedge funds shorting CDOs in The Big Short (both the book and the movie).

上述倍数仅指最终支付。如上所述,考虑许多投资者经历的按市值计价的观点也很重要。通过与大多数其他投资相同的棱镜观察这些策略的投资者可能非常不舒服。实际上,观察对冲基金下跌10-20%通常会让投资经理获得一些电话和会议来解释表现不佳。然而,根据这些CDO策略,CDS定价甚至2-3个基点的变化很容易导致波动超过20%,具体取决于所采用的杠杆。这是理解TRH策略的动态并避免陷入失控的重要原因之一。许多对冲基金在The Big Short(包括书籍和电影)中缩短了CDO,描绘了这种盯市市场的痛苦。

In a previous article (post here and PDF version) I highlighted multiple parallels between our current situation and other periods of market distortion stemming from price-insensitive strategies (e.g., the housing bubble and CPPI strategies). The bottom line is that it is very dangerous to pursue superficial investment strategies based on their historical performance. Just as structured credit products wreaked havoc on the credit markets and CPPI strategies culminated in Black Monday (-20% in a day!), passive and other price-insensitive strategies may be increasing the risk in the stock market while at the same time pushing down the prices of products and strategies to hedge the risk.

在之前的文章(此处发布和PDF版本)中,我强调了我们目前的情况与源于价格不敏感策略(例如房地产泡沫和CPPI策略)的其他市场扭曲时期之间的多种相似之处。最重要的是,根据其历史表现来寻求表面的投资策略是非常危险的。正如结构性信贷产品对信贷市场造成严重破坏,CPPI策略在黑色星期一达到高潮(一天为-20%!),被动和其他对价格不敏感的策略可能会增加股票市场的风险,同时推动 降低产品价格和策略以对冲风险。

Conclusions(4)

This article first highlighted the potential utility of TRH strategies versus traditional approaches to portfolio risk management (e.g., fixed asset allocations). I then discussed the factors I believe are critical to successfully executing TRH strategies. Lastly, I compared the current opportunities with those that were available in the period leading up to the credit crisis.

结论(4)

本文首先强调了TRH策略与传统投资组合风险管理方法(例如固定资产配置)的潜在效用。 然后我讨论了我认为对成功执行TRH策略至关重要的因素。 最后,我将目前的机会与信贷危机期间可获得的机会进行了比较。

I believe the historical performance and low price tags of passive strategies have attracted record magnitudes of assets and presumably been a major driver of the higher valuations. Moreover, the current popularity of short-volatility strategies are likely making TRH strategies cheaper to execute. In other words, I believe it is not only a good time to hedge, but the cost of hedging has been artificially dampened. On balance, I believe TRH strategies currently provide investors with attractive opportunities. Indeed, even those without equity risk exposure (e.g., total return investors or those who simply like asymmetric bets in their favor) may find TRH strategies compelling. I do not, however, believe these opportunities are as attractive as those available in the credit derivatives markets leading up to the collapse of the housing bubble.

我认为被动策略的历史表现和低价格已经吸引了创纪录的资产数量,并且可能是估值较高的主要推动因素。此外,目前短波动策略的普及可能使TRH策略的执行成本更低。换句话说,我认为现在不仅是对冲的好时机,而且人为地抑制了套期保值的成本。总的来说,我认为TRH策略目前为投资者提供了有吸引力的机会。事实上,即使那些没有股权风险的人(例如,总回报投资者或那些仅仅喜欢对他们有利的不对称投注的人)也可能会发现TRH策略具有吸引力。但是,我并不认为这些机会与信贷衍生品市场中的机会一样具有吸引力,导致房地产泡沫破灭。

TRH strategies are very complex and will often end up with polarized results. As highlighted in the disclaimer above, it is important to understand these strategies are speculative in nature. In particular, their success depends on the behavior of market prices – not fundamentals. Even if a strategy will ultimately be profitable, mark-to-market risks can make the experience painful and may result in investors abandoning the strategy at the wrong time. While I did not discuss it within this article, taxes are also relevant. Indeed, gains on many TRH strategies will be realized and thus trigger capital gains (sometimes short-term) taxes where applicable.

TRH策略非常复杂,往往会产生两极化的结果。正如上面的免责声明中所强调的那样,理解这些策略本质上是推测是很重要的。特别是,他们的成功取决于市场价格的行为 - 而不是基本面。即使策略最终会盈利,按市价计价的风险也会使经验变得痛苦,并可能导致投资者在错误的时间放弃策略。虽然我没有在本文中讨论它,但税收也是相关的。实际上,许多TRH战略的收益将会实现,从而在适用的情况下触发资本收益(有时是短期)税收。

Accordingly, I believe it is important for investors to understand the challenges involved with these strategies before executing them. Even then, I recommend limiting allocations to these strategies. In general, I would allocate no more than 5% of one’s overall portfolio or 10% of one’s equity allocation to TRH strategies.

因此,我认为投资者在执行这些策略之前了解这些策略所涉及的挑战非常重要。即便如此,我仍建议限制这些策略的分配。一般而言,我将不超过一个整体投资组合的5%或一个股权分配的10%分配给TRH策略。

- The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

- Join thousands of other readers and subscribe to our blog.

- This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

未经允许不得转载:美股开户者 » 长尾对冲(二)An Alternative Approach to Risk Management

美股开户者

美股开户者